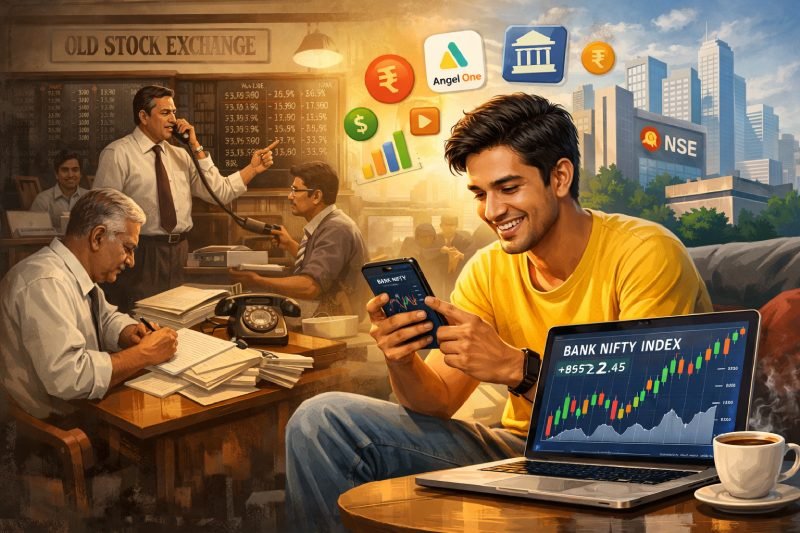

Remember When Stock Trading Felt Like a Rich Person’s Game?

Not too long ago, buying and selling shares felt like something only wealthy businessmen in big cities did. People had to call brokers on the phone, visit offices and fill out piles of paperwork just to place a single trade. Most ordinary Indians stayed far away from the stock market because it seemed complicated and honestly, a bit intimidating.

Today, a college student sitting in a small town can open a trading account on a smartphone within minutes. Trading apps have completely flipped the script. Platforms like Angel One, which is available on the Google Play Store, let users buy shares, track indices, study charts and manage their money without stepping out of the house. That is a massive shift, if you think about it.

What Is This Bank Nifty That Everyone Is Talking About, Then?

It’s probable that someone mentioned Bank Nifty while reading financial news or during a conversation about the stock market. The success of up to 14 large and frequently traded banking firms in India is tracked by the bank handy index, an industry index on the National Stock Exchange. The index was launched on 15th September 2003 with a base value of 1,000, and the base year was set at 2000. Every six months, the list of banks in the index is reviewed and updated. No single stock can hold more than 20 per cent weight, and the top three stocks combined cannot cross 45 per cent. This prevents any one bank from having too much influence on the overall index.

How Do They Actually Calculate the Value?

Here is where it gets a little technical, but stay with it because it is not as hard as it sounds. The bank nifty index uses something called the free float market capitalisation weighted method. In plain words, only the shares that are freely available for public trading are counted.

Shares held by promoters or locked in for other reasons are left out. Each bank’s market price is multiplied by its investible weight factor to get its free float market value. All these values are then added together, and that total determines the index number you see flashing on your screen every trading day.

Who Gets to Be Part of This Exclusive Club?

Not just any bank can make it into the index. It needs at least six months of listing history and must have been traded on at least 90 per cent of the trading days during that period.

On top of that, the stock must be eligible for trading in the Futures and Options segment. Banks are ranked by their average free float market capitalisation, and only those meeting a minimum size threshold get shortlisted.

Why Does Any of This Matter to a Regular Person?

Because half the battle is knowing where to look. Whether someone is curious about banking sector trends or actively placing trades, trading apps like Angel One put real time data right at their fingertips.

Watching the bank nifty index helps investors understand how the banking sector is performing without having to track each bank separately. In a nation where millions of new buyers join the market each year, having access to trustworthy resources and understandable information is more than simply useful. It is truly freeing.